Mergers and acquisitions are quintessential to any dynamic enterprise looking to expand its market footprint. Businesses, whilst weighing options for business sustainability, could be purely for consolidation, market expansion to expand their reach, new segments, gain market share or any other reason.

A merger is the agreed understanding with a fusion of two companies on broadly equal terms into a new entity. However, not all mergers are the same; they have their own objectives, which could be a fusion of two conglomerates or horizontal to vertical with each of its own considerations.

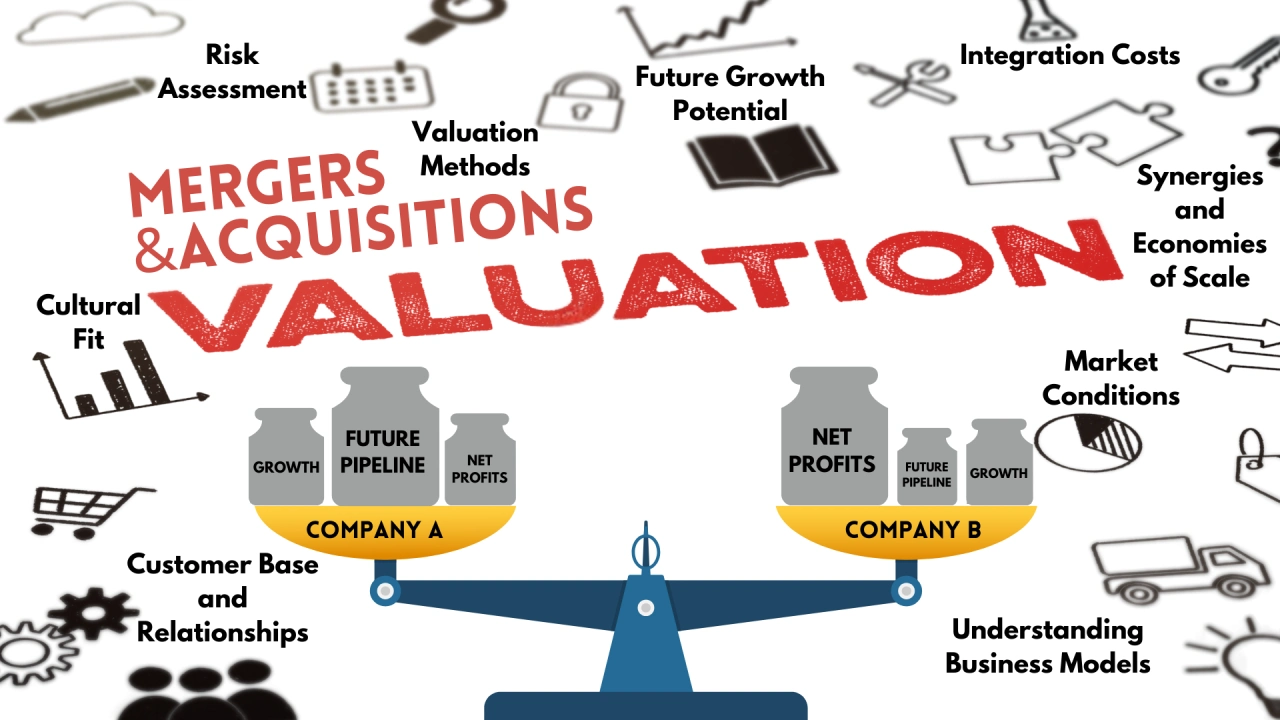

These inherently complex processes require careful analysis and strategic planning to ensure successful integration and value creation. In typical business scenarios, factors such as financial performance, market conditions, and operational synergies must be meticulously evaluated to arrive at a fair valuation.

However, this complexity is further amplified when the merging companies operate under different business dynamics, such as varying profitability models, revenue structures, or market positioning. These disparities demand even closer scrutiny to ensure that both entities are appropriately valued and that the merger strategy addresses not only financial considerations along with long-term sustainability and growth.

Accurately evaluating companies with different business models is essential to crafting a merger strategy that captures the true value of both entities and maximizes post-merger synergies.

In the case of intended mergers, when valuing two companies with different business models, there are specific critical valuation approaches to follow. I do not agree with upending enterprise valuations based only on higher margin criteria versus traditional businesses with low margins, as they have inherent advantages with their market dynamics. Therefore, any valuation exercise must factor holistic pros and cons of the two companies before arriving at any enterprise valuation.

Furthermore, giving valuation uptake based purely on its higher-margin tangent may be shortsighted until the business can sustain these margin levels and growth in post-merger dynamics.

The valuation of companies in the context of mergers requires a deep dive beyond balance sheets and cash flows. It requires reviewing revenue backlog dynamics, treating cost of sales and other post-merger cost considerations. When evaluating businesses, we often use the term ‘stripping’ to arrive at realistic cost and revenue assumptions wherein all business dynamics are evaluated based on their long-term sustainability rather than just current or past records.

In my professional journey of thirty years, I have managed or seen hundreds of merger and acquisition deals from close quarters. No singular method can be applied in valuations. In essence, hundreds of permutations and combinations are taken into consideration when treating balance sheet items, revenue assumptions, cost provisions, and goodwill treatment methods.

Before arriving at any valuation in a merger between two companies, the following considerations should be considered:

- Understanding Business Models: Different business models can significantly impact profitability, and even if it is the same industry, specific benchmarks may not apply. It’s crucial to understand how each company’s model generates revenue, how it treats its expenses in the current format and how it will look in post-merger scenarios. If it is a management-centric business with downstream operations cost outsourced, we must look at its sustainable prospects in the post-merger scenario. Eventually, if both businesses are in the same industry, it is essential to ascertain if the lower margin business is in line with its market landscape, which is very competitive. However, in traditionally lower margin businesses, other positive factors like higher revenue backlog, higher free cash flow element, lower overheads and inventories may prevail upon the former regarding its resilience advantage and growth potential. Specific industries with traditional low margin often rely on high volume sales, their scale of growth and past track record. However, in the case of high margins, unless businesses operate with higher efficiency, lower overheads, and no subsidized cost, the higher valuation basis is justified in terms of systems or people.

- Integration Costs: Consider the costs associated with integrating the two businesses. Transitioning from a high-margin business model to one operating on lower margins may require significant changes in operations, processes, and culture. After blending that business, is it possible to sustain those margins and vice versa? Can the lower-margin business sustain its track record in terms of growth, or will it bow down due to increased costs due to the growth trajectory on its margin? These questions have to be aligned with the long-term view of the business and evaluate pre- and post-merger business models.

- Synergies and Economies of Scale: Analyse potential synergies arising from the acquisition and which party will likely gain more. This could include cost savings from shared resources, improved purchasing power, or enhanced distribution networks that could help improve the margins of the acquired business and the due impact of such should be recognized.

- Market Conditions: Examine the market conditions for both businesses. If the low-margin business is able to sustain itself because of critical mass, though it may be operating in a highly competitive environment, it is possible to improve the net margins due to cost consolidation in a post-merger scenario. Conversely, if the high-margin business operates in a competitive industry, it may see challenges in revenue uptake and margin retention with potentially limited growth.

- Customer Base and Relationships: Evaluate the customer base of both businesses. Can the high-margin company leverage its customer relationships to retain and enhance its offerings to similar business profiles versus the lower-margin business, with demonstrable assumptions to improve profitability?

- Future Growth Potential: Assess the growth potential of both businesses. If they have opportunities for expansion, innovation, and retention, sometimes even at low margins, they can benefit from the investment to support growth capital despite their current low margins.

- Risk Assessment: Different business models come with different risks. High-margin businesses may be more vulnerable to market changes in terms of business retention, while low-margin ones may face cost fluctuations and competition risks. A thorough risk assessment is essential. High margins may have often been due to subsidies or concessional rates on certain key costs. For instance, cross charges from principal or visa costs and related costs of people, mostly in government cases, may be lower. It should be taken into consideration that the market risks may limit or even reduce higher margin business in the future in case of a downturn in the market.

- Valuation Methods: Using the appropriate valuation method and agreement on the appropriate compensation methods according to different business models is essential. For example, whilst discounted cash flow (DCF) analysis may provide a more accurate valuation for the high-margin business, a market-comparable approach may work better for the low-margin business.

- Cultural Fit: The cultural alignment between the two companies can significantly affect the acquisition’s success. A mismatch in company culture may hinder operational effectiveness and employee retention. Whilst this cannot be quantified directly, the two cultures should be evaluated pre-merger, and only one culture should be aligned and agreed upon to ensure sustainable transactions.

Overall, a comprehensive business review, due diligence process, and integration strategy that takes into account these considerations will be vital for the successful valuation and integration of the two companies.